Retirement Planning: Build a 5 Crore Corpus by 60

Why Retirement Planning in India is Essential ?

Retirement planning in India ensures a financially secure future. Without proper planning, managing expenses can become difficult. A well-structured investment strategy ensures a secure and stress-free retirement.

How Much Do You Need for Retirement?

A 5 crore corpus by 60 allows a comfortable lifestyle. With inflation, expenses increase over time. A solid plan helps to meet future needs without financial stress.

Steps to Build a 5 Crore Corpus by 60:

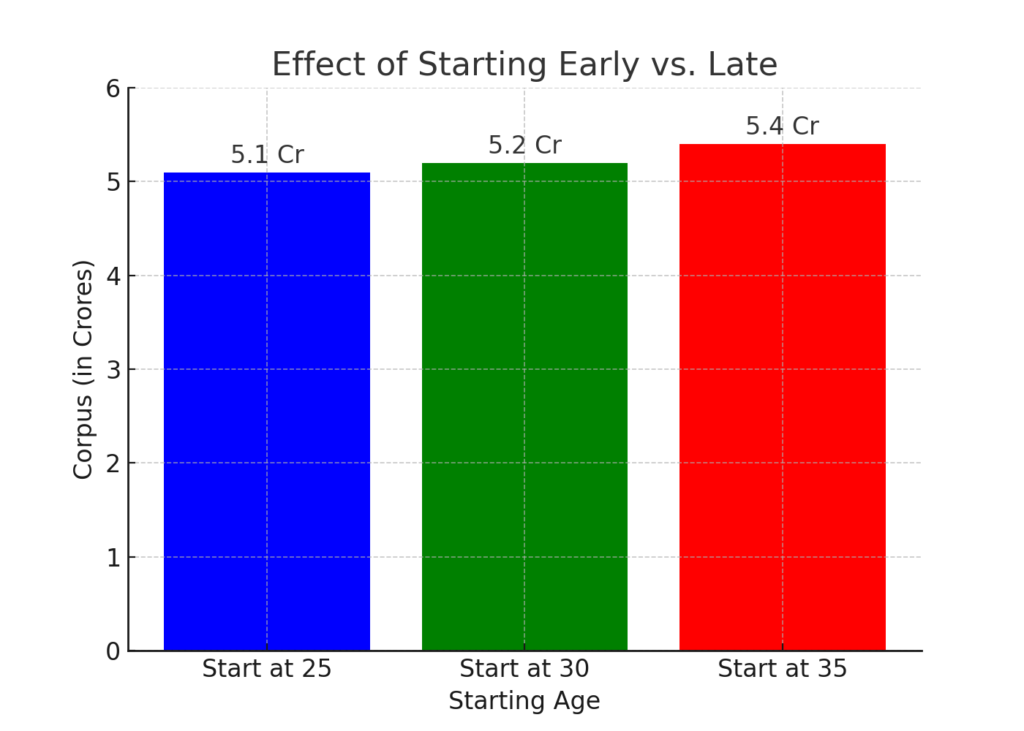

The earlier you start, the more you benefit from compounding. Even small investments grow significantly over time.

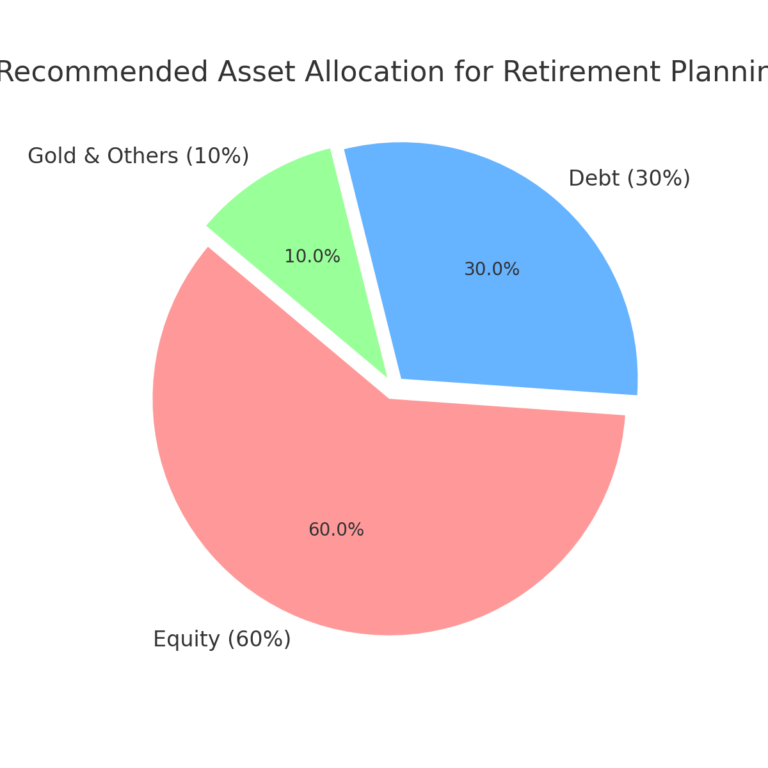

Investing in mutual funds, equities, and debt instruments diversifies your portfolio. Balanced risk-taking ensures steady growth.

3. Invest in Regular Mutual Fund Plans

Regular plans provide expert fund management. Professional fund managers help optimize returns and reduce risks. Their expertise ensures better decision-making.

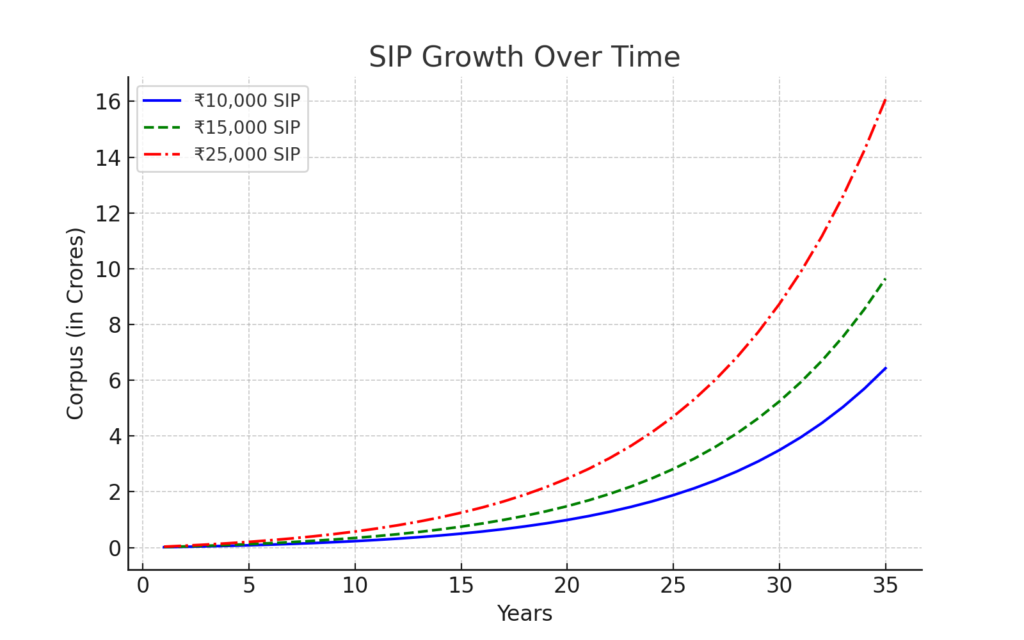

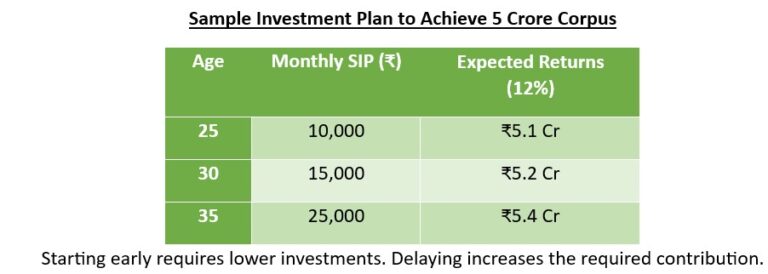

4. Systematic Investment Plan (SIP) is the Key

SIP helps to invest small amounts regularly. It also reduces the risk of market fluctuations. Long-term SIPs generate substantial wealth.

5. Increase Investments with Income Growth

As your salary increases, enhance your investments. Step-up SIPs help to achieve higher returns.

6. Focus on Tax-Efficient Investments

Investing in tax-saving instruments boosts returns. ELSS funds, PPF, and NPS offer tax benefits while growing wealth.

7. Monitor and Rebalance Your Portfolio

Reviewing your portfolio helps to stay on track. Adjustments based on market conditions improve performance.

How Regular Mutual Fund Plans Help in Long-Term Growth

Many investors choose direct plans to save commissions. However, professional fund management in regular plans leads to higher returns. Expert fund managers make informed decisions. Their strategies help to maximize profits.

The Power of Compounding

Compounding accelerates wealth creation. Reinvesting returns generates exponential growth. Starting early and staying invested enhances the benefits.

Conclusion

Retirement planning in India requires discipline and smart investments. A 5 crore corpus by 60 is achievable with consistent SIPs, tax-efficient strategies, and professional fund management. Plan today for a stress-free tomorrow.

Disclaimer: Mutual fund investments are subject to market risks. Please consult a financial advisor before investing.

Market conditions change rapidly, and staying informed is crucial. Follow reliable financial news sources, analyse expert opinions, and track regulatory updates. Stay connected with us for more insights on market trends and stock analysis.

Disclaimer:

The information provided in this blog is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. Equity investments are subject to market risks, and past performance is not indicative of future results.

This content does not constitute an offer, solicitation, or recommendation to buy or sell any securities, nor does it guarantee any specific financial outcome. Investors should conduct their own research, assess their risk tolerance, and consult with a certified financial advisor or investment professional before making any investment decisions.

The author and publisher of this blog are not liable for any financial losses, decisions, or actions taken based on the information provided. Invest wisely and at your own discretion.