Best Investment Plans for Child’s Higher Education India

Introduction

Planning for your child’s education is a major milestone for every parent. With the rising cost of college and professional courses, securing your child’s future is more important than ever. Choosing the best investment plans for child’s higher education India helps you stay financially prepared and stress-free.

Why Financial Planning is Important for Child’s Education

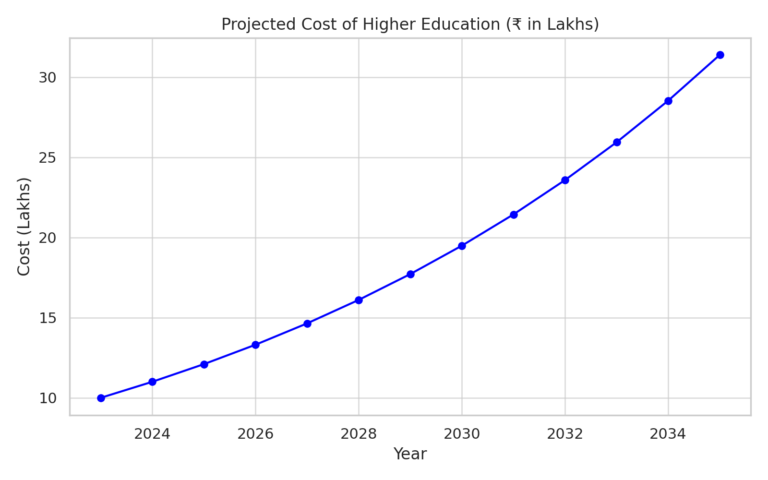

Every year, education costs are rising. A course that costs ₹10 lakhs today may cost over ₹30 lakhs after 12–15 years. Without planning, this can create a financial burden. The best investment plans for child’s higher education India can ease that stress.

Step-by-Step Guide to Planning Your Child’s Higher Education:

Step 1: Know the Estimated Future Education Cost

Estimate the future value of your child’s desired course. Use a simple formula considering inflation. For example, if a course costs ₹10 lakhs today, at 10% inflation, it will cost ₹26 lakhs in 10 years.

Step 2: Set a Target Year and Amount

You need to know when your child will go to college and how much the course will cost then. This helps decide the type and duration of the investment.

Step 3: Choose the Right Investment Option

Now that you know the goal amount and time, you can choose the best investment plans for child’s higher education India.

Popular Investment Plans for Child’s Higher Education India:

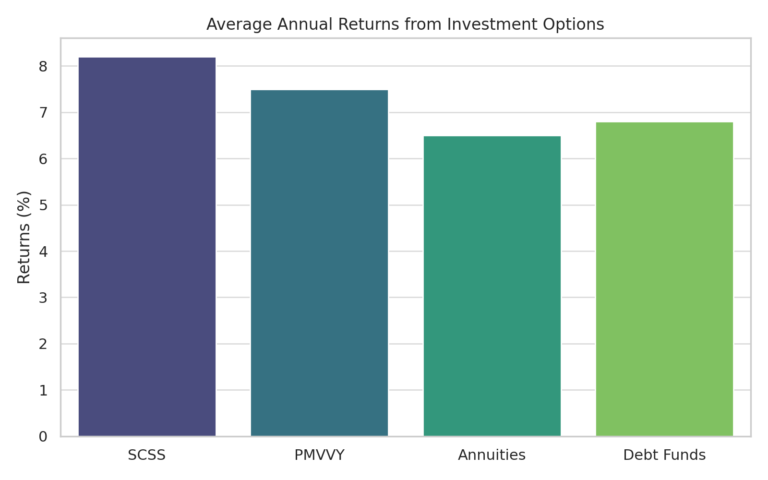

Senior Citizens’ Savings Scheme (SCSS)

SCSS is ideal if grandparents want to invest for the child. It offers around 8.2% interest annually. It is a government-backed plan, making it very safe.

Pradhan Mantri Vaya Vandana Yojana (PMVVY)

PMVVY is a pension scheme for senior citizens. If grandparents receive a regular pension, part of it can be saved for the child’s education. Returns are around 7.4% (It Changed according to govt.)

Annuities

Insurance companies offer annuities that give fixed income after retirement. Parents can choose deferred annuity plans that start giving regular income by the time their child enters college.

Debt Mutual Funds

These funds invest in bonds and government securities. They are less risky than equity funds. Short-term and medium-term debt funds can be used for education goals.

Success Stories:

Story 1: Planning with SCSS & PMVVY – Ravi and Meera

Ravi and Meera, a couple from Pune, wanted to save for their daughter’s medical degree. They involved Ravi’s father, who invested ₹15 lakhs in SCSS and PMVVY. After 10 years, they had close to ₹30 lakhs for college fees.

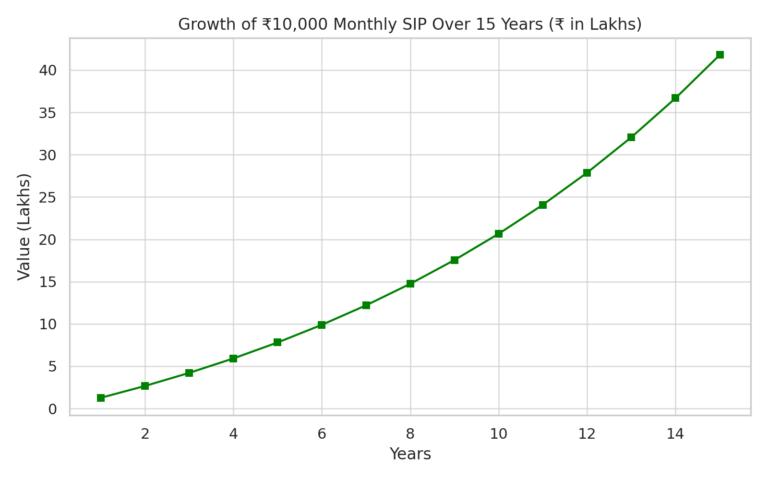

Story 2: SIP in Debt Funds – Anita, Age 32

Anita from Delhi started a ₹10,000 monthly SIP in debt mutual funds when her son was 3 years old. After 15 years, she had saved around ₹41 lakhs, enough for his MBA.

Tips for Parents to Stay on Track -

- Start early to benefit from compounding.

- Review investments yearly.

- Involve family members like grandparents.

- Avoid using education loans as the first option.

- Always choose the best investment plans for child’s higher education India based on your risk appetite and time frame.

Conclusion

Education is the best gift you can give to your child. With the best investment plans for child’s higher education India, you can ensure a smooth journey to their dreams without any financial burden.

Disclaimer: Mutual fund investments are subject to market risks. Please consult a financial advisor before investing.

Market conditions change rapidly, and staying informed is crucial. Follow reliable financial news sources, analyse expert opinions, and track regulatory updates. Stay connected with us for more insights on market trends and stock analysis.

Disclaimer:

The information provided in this blog is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. Equity investments are subject to market risks, and past performance is not indicative of future results.

This content does not constitute an offer, solicitation, or recommendation to buy or sell any securities, nor does it guarantee any specific financial outcome. Investors should conduct their own research, assess their risk tolerance, and consult with a certified financial advisor or investment professional before making any investment decisions.

The author and publisher of this blog are not liable for any financial losses, decisions, or actions taken based on the information provided. Invest wisely and at your own discretion.