Gold ETFs vs. Physical Gold: Where Should You Invest in 2025?

Introduction:

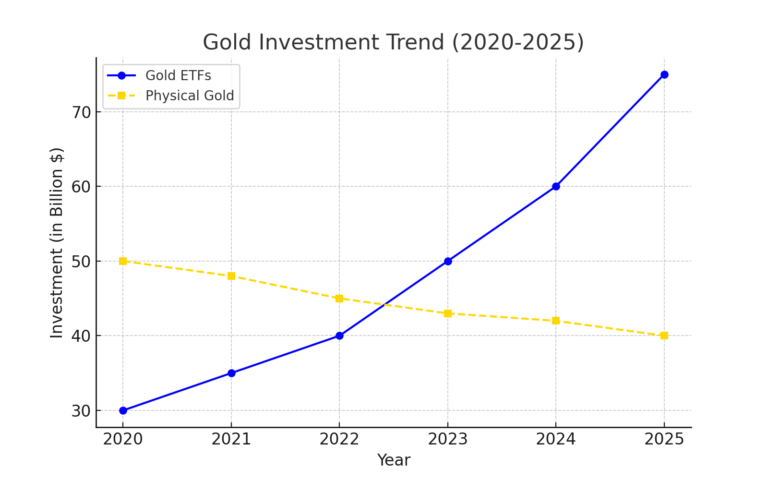

Gold has always been a favoured investment. In 2025, investors face a common question Gold ETFs vs. Gold where should they invest? Both options have advantages and downsides. Understanding them helps in making the right decision.

What Are Gold ETFs?

Gold Exchange- Traded finances ( ETFs) are fiscal instruments. They track gold prices and offer an easy way to invest in gold. Investors don’t need to buy or store physical gold. rather, they hold shares that represent gold.

Benefits of Gold ETFs:

Easy to Trade – They can be bought and vended like stocks.

No storehouse Hassle – No need for lockers or keeping.

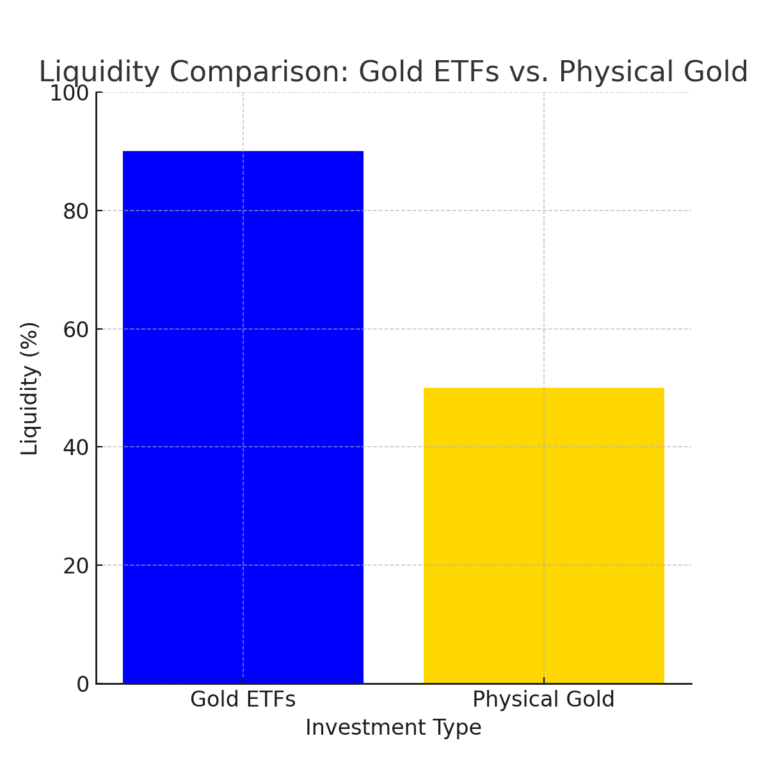

High Liquidity – Easy to convert into cash.

Transparent Pricing – Prices match the gold request rate.

Drawbacks of Gold ETFs:

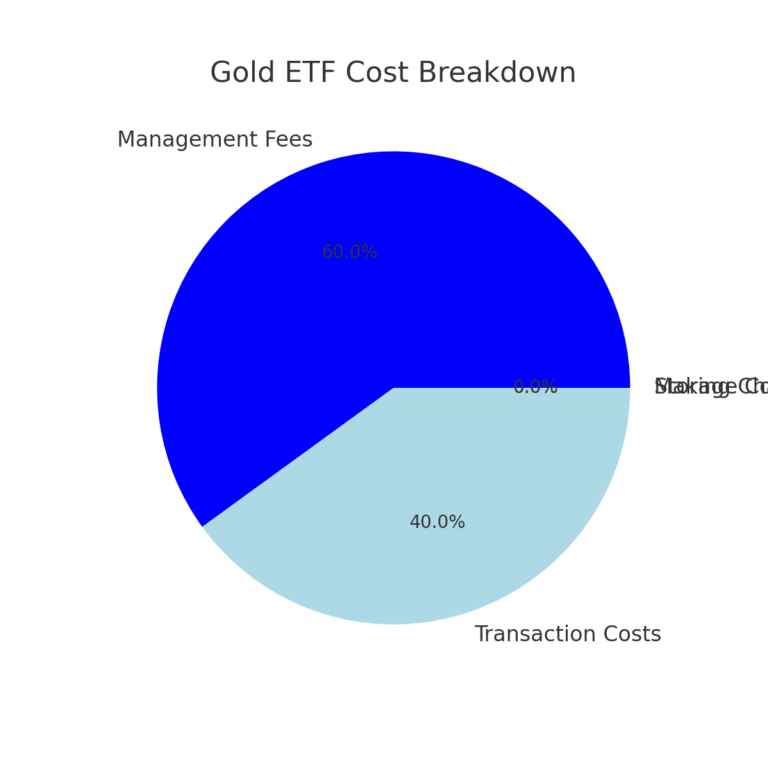

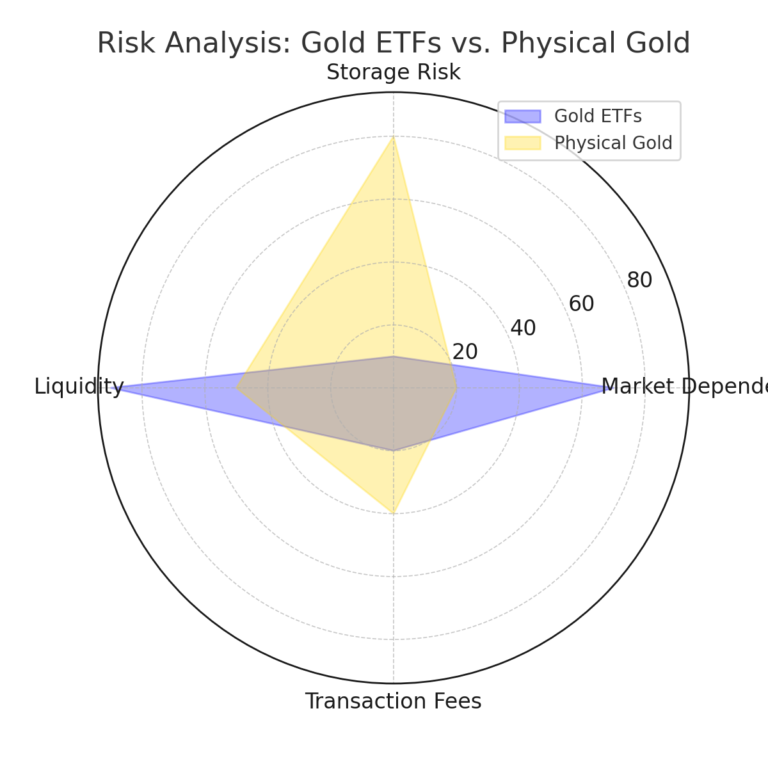

- operation freights – Fund directors charge a small figure.

- No Physical Possession – Investors don’t enjoy factual gold.

- Request reliance – Prices may change due to request conditions.

What Is Physical Gold?

Physical gold refers to coins, bars, and jewellery. Investors buy and store it themselves. Many prefer it due to its tangible nature and emotional value.

Benefits of Physical Gold

- Tangible Asset – Can be held and stored.

- No Counterparty Risk – Not dependent on financial institutions.

- Accepted Globally – Easily sold anywhere.

- Emotional Value – Used in traditions and gifting.

Drawbacks of Physical Gold

- Storage Issues – Requires safekeeping.

- Risk of Theft – Needs proper security.

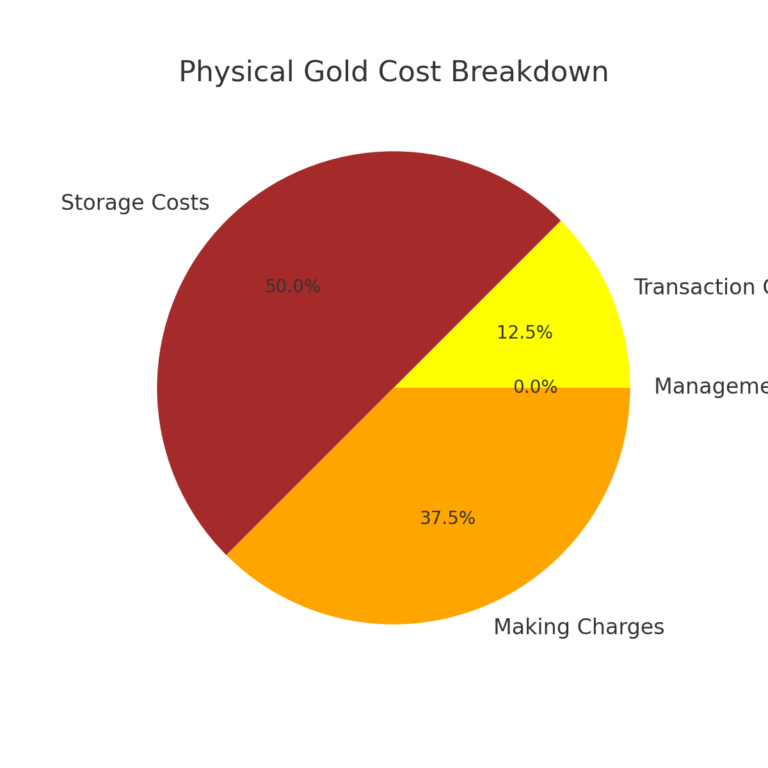

- Making Charges – Additional costs for jewellery.

- Liquidity Concerns – Selling may take time.

Gold ETFs vs. Physical Gold: Key Differences

| Factor | Gold ETFs | Physical Gold |

| Storage | No storage needed | Requires secure storage |

| Liquidity | Highly liquid | Selling may take time |

| Costs | Management fees apply | Making charges, storage costs |

| Risk | No theft risk | Risk of theft, loss |

| Accessibility | Easy to buy and sell | Needs physical transaction |

| Investment Size | Can start small | Requires a larger amount |

Which Is Better for You in 2025?

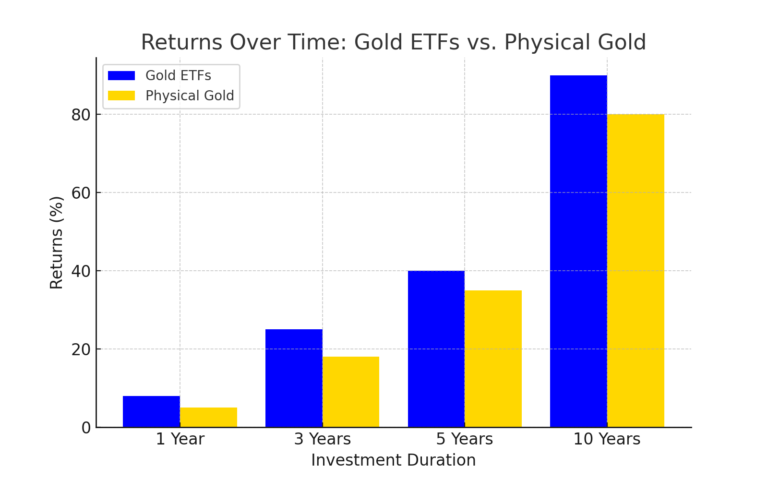

The right choice depends on investment goals. Gold ETFs suit those seeking convenience, liquidity, and transparency. Physical gold is ideal for those valuing tangible assets and long-term holding.

Final Thoughts:

Gold remains a solid investment in 2025. Gold ETFs offer ease and liquidity, while physical gold provides security and emotional value. Understanding the pros and cons helps in making an informed decision. Choose wisely based on your financial goals.

Market conditions change rapidly, and staying informed is crucial. Follow reliable financial news sources, analyse expert opinions, and track regulatory updates. Stay connected with us for more insights on market trends and stock analysis.

Disclaimer:

The information provided in this blog is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. Equity investments are subject to market risks, and past performance is not indicative of future results.

This content does not constitute an offer, solicitation, or recommendation to buy or sell any securities, nor does it guarantee any specific financial outcome. Investors should conduct their own research, assess their risk tolerance, and consult with a certified financial advisor or investment professional before making any investment decisions.

The author and publisher of this blog are not liable for any financial losses, decisions, or actions taken based on the information provided. Invest wisely and at your own discretion.