How to Build Wealth: Smart Investor’s Blueprint for 2025

Introduction

Building wealth requires smart strategies and disciplined investing. In 2025 and beyond, financial success will depend on informed decisions and long-term planning. This guide will help you create a solid investment blueprint for lasting wealth

1. Set Clear Financial Goals

Define your wealth-building objectives. Whether it’s early retirement, a dream home, or financial security, having clear goals will guide your investment journey.

Short-Term vs. Long-Term Goals

- Short-term: Emergency fund, debt repayment

- Long-term: Retirement savings, real estate investments

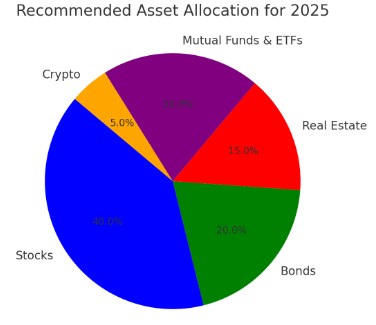

2. Diversify Your Investments

A well-balanced portfolio minimizes risk. Spread your investments across different asset classes for stability.

Best Diversification Strategies

- Stocks: Growth potential

- Bonds: Stability

- Real Estate: Passive income

- Mutual Funds & ETFs: Professional management

A well-balanced portfolio minimizes risk. Spread your investments across different asset classes for stability.

Best Diversification Strategies

- Stocks: Growth potential

- Bonds: Stability

- Real Estate: Passive income

- Mutual Funds & ETFs: Professional management

3. Invest in Passive Income Streams

Generating passive income ensures financial freedom. Start by investing in assets that generate returns without active involvement.

Top Passive Income Options

- Dividend Stocks

- Real Estate Rentals

- Bonds and Fixed Deposits

4. Leverage Technology for Smart Investing

Use financial tools and apps to automate investments and track market trends.

Top Investment Apps for 2025

- Robinhood: Stock trading

- Wealthfront: Robo-advisory

- CoinBase: Crypto investments

5. Minimize Debt and Maximize Savings

Debt can drain wealth. Focus on clearing high-interest loans and increasing savings.

Smart Debt Management

- Pay off credit card debt first

- Refinance loans for lower interest rates

- Automate savings to build financial security

6. Stay Updated with Market Trends

Financial markets evolve. Keep learning to make informed decisions.

Ways to Stay Updated

- Follow financial news

- Read investment blogs

- Join investor communities

7. Plan for Retirement Early

Starting early ensures financial security. Take advantage of retirement plans like 401(k), IRAs, and pension funds.

Best Retirement Strategies

- Maximize employer contributions

- Invest in tax-saving retirement funds

- Diversify retirement portfolios

Conclusion

Wealth-building takes time and strategy. By setting goals, diversifying investments, leveraging technology, and minimizing debt, you can secure financial success in 2025 and beyond. Start today and stay consistent!

Disclaimer:

The information provided in this blog is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. Equity investments are subject to market risks, and past performance is not indicative of future results.

This content does not constitute an offer, solicitation, or recommendation to buy or sell any securities, nor does it guarantee any specific financial outcome. Investors should conduct their own research, assess their risk tolerance, and consult with a certified financial advisor or investment professional before making any investment decisions.

The author and publisher of this blog are not liable for any financial losses, decisions, or actions taken based on the information provided. Invest wisely and at your own discretion.