IndusInd Bank Shares: A Deep Analysis of Recent Trends

Introduction: IndusInd Bank Shares Face a Sharp Decline

IndusInd Bank shares have recently seen a drastic fall. Accounting discrepancies and leadership concerns have raised doubts among investors. This article explores the reasons behind the decline and what it means for future investors.

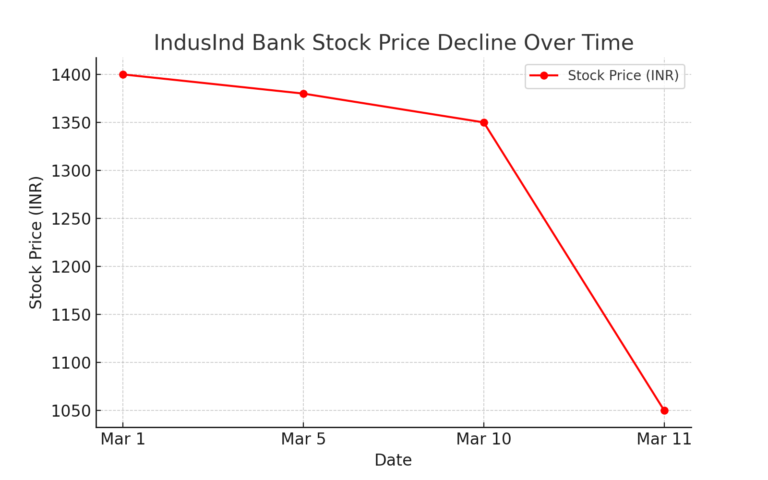

IndusInd Bank Shares Drop Over 22%

On March 11, 2025, IndusInd Bank shares fell over 22%. Accounting issues in forex derivatives led to significant earnings hit. The estimated loss ranges between ₹1,500 to ₹2,000 crores. Investors reacted negatively, causing a sharp decline in the stock price.

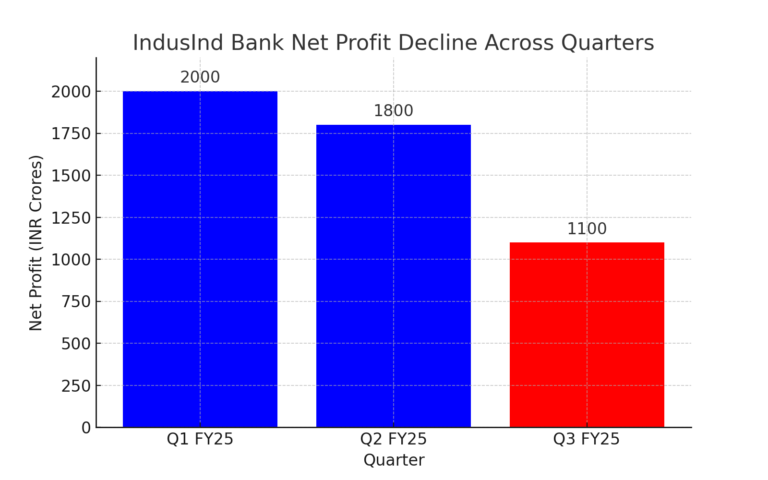

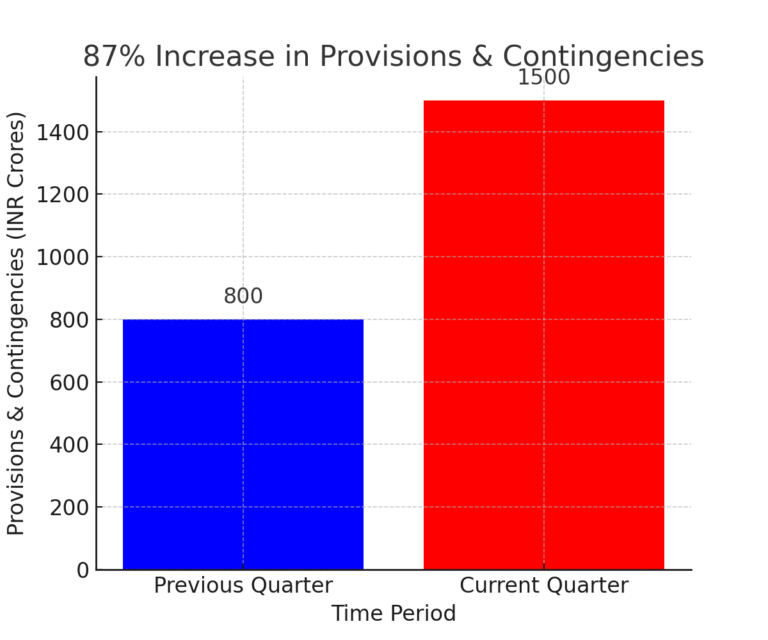

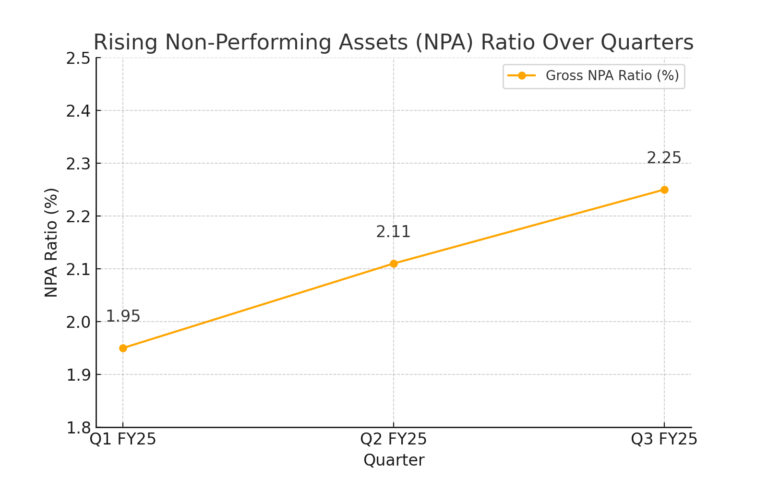

Impact on Financial Performance

- Stock Price Drop Over Time – A line chart showing the decline in IndusInd Bank shares.

2. Net Profit Decline – A bar chart comparing net profit across quarters.

3. Increase in Provisions & Contingencies – This chart illustrates the 87% rise.

4. Rising NPAs – A line chart showing the increasing NPA ratio.

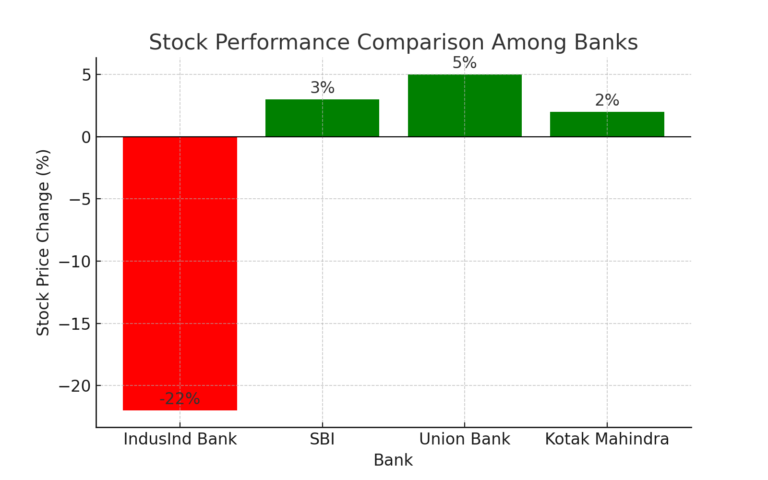

5. Comparison with Competitor Banks – A bar chart comparing stock price performance..

CEO Tenure Concerns Affect IndusInd Bank Shares

The Reserve Bank of India (RBI) extended CEO Sumant Kathpalia’s tenure for only one year. Investors expected a three-year term. This uncertainty further impacted IndusInd Bank shares, pushing them to a multi-year low.

Market Position Compared to Competitors

IndusInd Bank shares performed worse than other banks. In contrast, Union Bank, SBI, and Kotak Mahindra Bank saw gains. Heavy trading volumes showed investor concerns.

Analyst Views on IndusInd Bank Shares

Many analysts have revised their outlook on IndusInd Bank shares. Some suggest the stock could be derated due to the ongoing crisis. While some recommend holding, others advise caution before investing further.

Should You Invest in IndusInd Bank Shares?

The financial market operates under strict regulations designed to protect investors. Regulatory bodies like the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) actively monitor banks and financial institutions to ensure transparency and stability. Measures such as stress testing, risk management guidelines, and regular audits help maintain trust in the banking system.

Investors need to have faith in the financial system and regulatory framework before making any decisions. Market fluctuations are common, and institutions take corrective steps to address concerns. It is essential to stay informed and rely on factual data rather than reacting to short-term market movements. Understanding the regulatory safeguards in place can help investors make well-informed choices without unnecessary panic.

Conclusion: Future Outlook for IndusInd Bank Shares

IndusInd Bank shares are facing a critical phase. Accounting issues and leadership concerns have impacted investor confidence. Before investing, it is crucial to monitor how the bank addresses these challenges.

Market conditions change rapidly, and staying informed is crucial. Follow reliable financial news sources, analyse expert opinions, and track regulatory updates. Stay connected with us for more insights on market trends and stock analysis.

Disclaimer:

The information provided in this blog is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. Equity investments are subject to market risks, and past performance is not indicative of future results.

This content does not constitute an offer, solicitation, or recommendation to buy or sell any securities, nor does it guarantee any specific financial outcome. Investors should conduct their own research, assess their risk tolerance, and consult with a certified financial advisor or investment professional before making any investment decisions.

The author and publisher of this blog are not liable for any financial losses, decisions, or actions taken based on the information provided. Invest wisely and at your own discretion.