Introduction

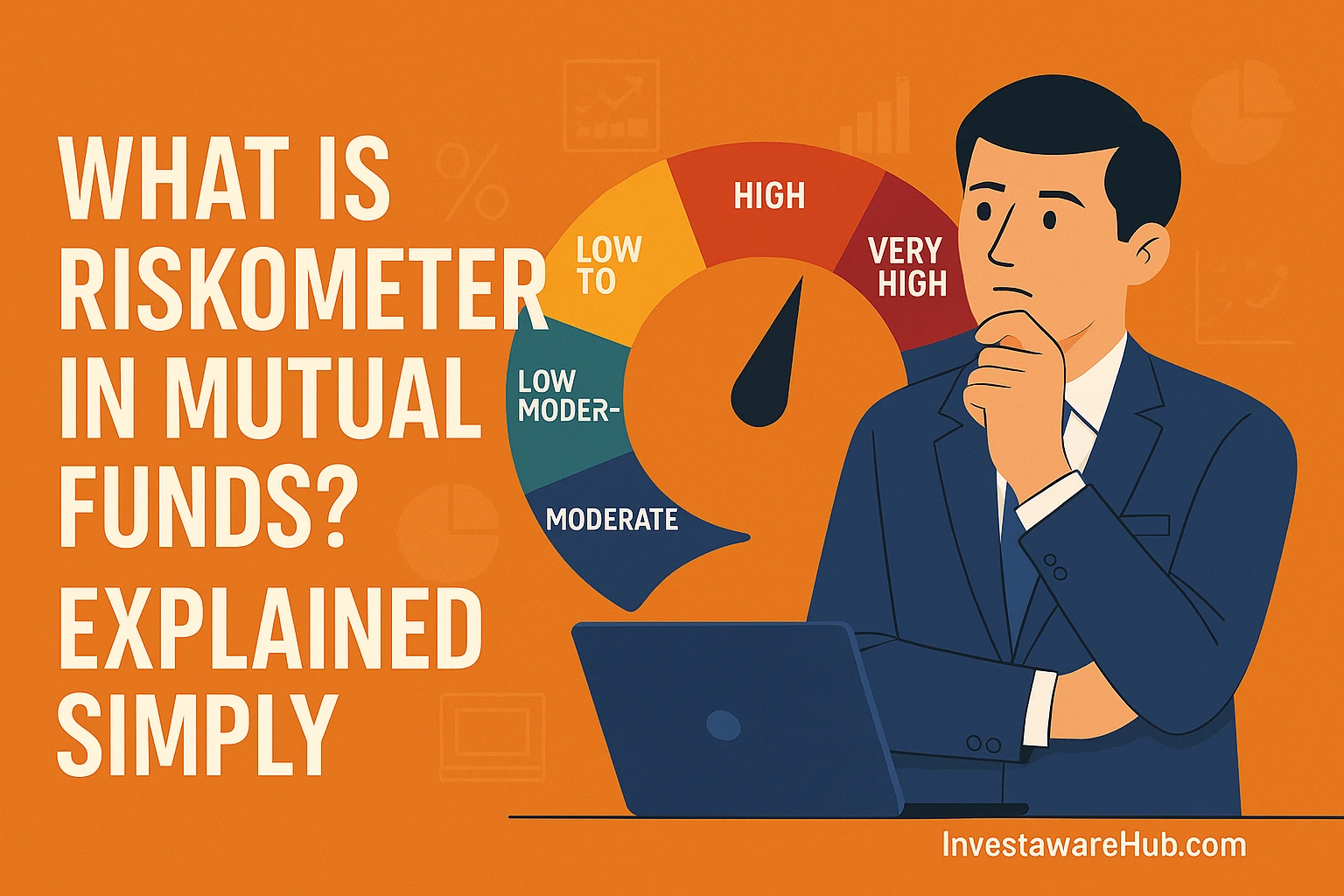

Investing in mutual funds can be exciting but also risky. To help investors understand risks, the Mutual Fund Riskometer comes into play. It is a tool used to indicate the risk level of a mutual fund scheme. Knowing the risk involved helps investors make better financial decisions. Let’s dive into what the Riskometer is and why it matters.

What is a Mutual Fund Riskometer?

The Mutual Fund Riskometer is a graphical representation that indicates the risk associated with a mutual fund scheme. It is mandatory for all Asset Management Companies (AMCs) to display it. The Riskometer categorizes funds into six levels of risk:

Low

Low to Moderate

Moderate

Moderately High

High

Very High

The risk level shown helps investors match their risk tolerance with the fund’s risk profile. It gives a clear idea of the potential market fluctuations and the risk of losing capital.

Mutual Fund Riskometer

1. Risk Categories in Mutual Funds

2. Sector-wise Risk Levels

3. Analysts' Risk Predictions

Why Was the Riskometer Introduced?

SEBI (Securities and Exchange Board of India) introduced the Riskometer to simplify risk assessment. Earlier, investors faced challenges in understanding fund risk. The Riskometer offers a simple, visual way to gauge risk.

How Does the Riskometer Work?

The risk level of a mutual fund depends on its portfolio. Funds holding volatile assets like equities generally show a higher risk level. On the other hand, funds investing in debt or government securities usually have a lower risk level.

Sector-Wise Impact of Mutual Fund Riskometer

Different sectors experience varying impacts based on their risk levels:

1. Equity Mutual Funds:

Usually labeled as High or Very High risk.

Market volatility affects returns significantly.

Riskometer helps investors identify safer equity options.

2. Debt Mutual Funds:

Typically categorized as Low or Moderate risk.

Risk increases during market downturns or rising interest rates.

Suitable for conservative investors.

3. Hybrid Mutual Funds:

Combine both debt and equity components.

Risk levels vary from Moderate to High.

Offers balanced risk and reward.

4. Sectoral and Thematic Funds:

Risk can be High or Very High due to focused investments.

Sectoral shifts can affect performance.

Suitable for those with sector-specific knowledge.

Analysts' Predictions on Riskometer

Analysts believe that the Mutual Fund Riskometer helps build investor confidence. More accurate risk labeling has improved decision-making. Analysts also predict that as market conditions change, the risk levels of some funds may be updated. Keeping track of the Riskometer can help investors stay informed.

Why Should You Care?

Understanding the Mutual Fund Riskometer helps in aligning your investment with your risk appetite. Investors often ignore risk levels and later face losses. Regularly checking the Riskometer ensures that your investment strategy remains aligned with your financial goals.

Final Thoughts

The Mutual Fund Riskometer acts as a guiding tool for investors. It is not just about returns but also about understanding the risk associated. Use the Riskometer wisely to make informed investment choices. Always assess the risk before investing.

Disclaimer: Mutual fund investments are subject to market risks. Please consult a financial advisor before investing.

Market conditions change rapidly, and staying informed is crucial. Follow reliable financial news sources, analyse expert opinions, and track regulatory updates. Stay connected with us for more insights on market trends and stock analysis.

📚 Frequently Asked Questions (FAQs)

Q1: What is a Mutual Fund Riskometer?

Q2: How is the Riskometer useful for investors?

Q3: Who decides the risk level shown on the Riskometer?

Q4: Does the Riskometer guarantee fund performance?

Q5: Can the risk level change over time?

Q6: Is the Riskometer mandatory for all mutual funds?

Q7: How can I use the Riskometer to choose the right fund?

Q8: Does the Riskometer consider sector-wise risk?

Disclaimer:

The information provided in this blog is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. Equity investments are subject to market risks, and past performance is not indicative of future results.

This content does not constitute an offer, solicitation, or recommendation to buy or sell any securities, nor does it guarantee any specific financial outcome. Investors should conduct their own research, assess their risk tolerance, and consult with a certified financial advisor or investment professional before making any investment decisions.

The author and publisher of this blog are not liable for any financial losses, decisions, or actions taken based on the information provided. Invest wisely and at your own discretion.