Mutual Fund Taxation: Save More on Your Returns

Introduction:

Mutual Fund Taxation in India affects investment returns significantly. Understanding how different mutual funds are taxed can help you save more.

As of March 30, 2025, the taxation rates for mutual funds in India depend on the type of mutual fund (equity-oriented, debt-oriented, or hybrid), the holding period (short-term or long-term capital gains), and the applicable income tax rules introduced in recent budgets, particularly the Finance Act 2023 and Union Budget 2024. Below is a breakdown of the current mutual fund taxation rates in India for the financial year 2025-26, based on the latest available information

Types of Mutual Funds and Their Taxation

Funds that invest at least 65% of their total proceeds in equity shares of domestic companies.

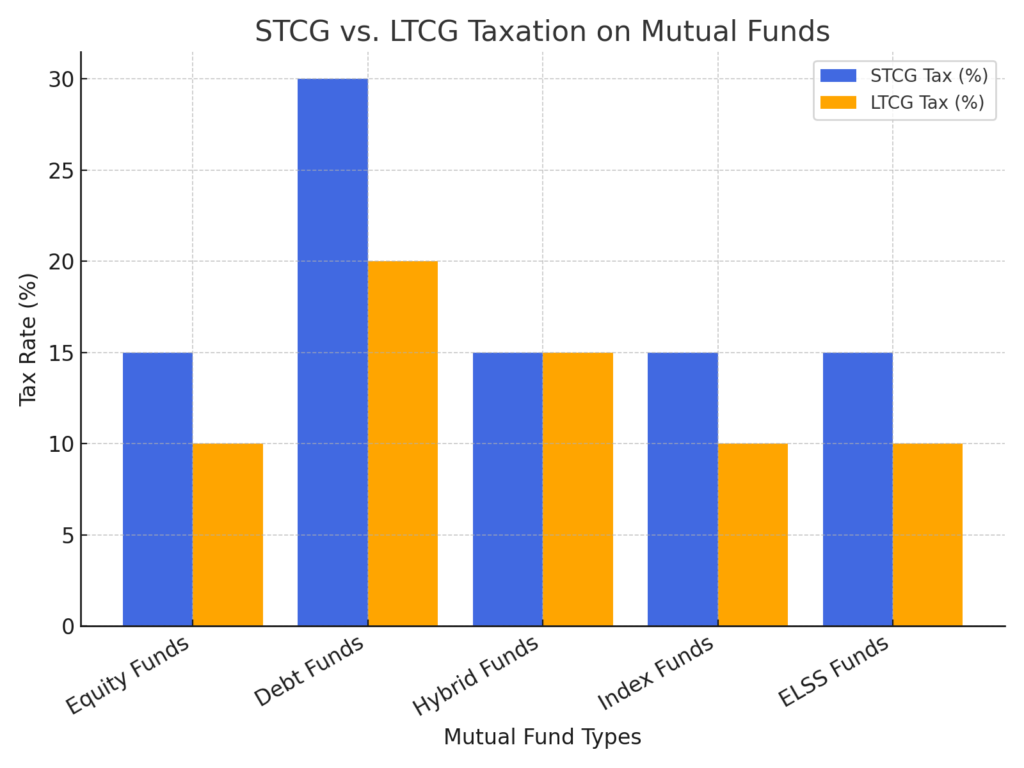

Short-Term Capital Gains (STCG):

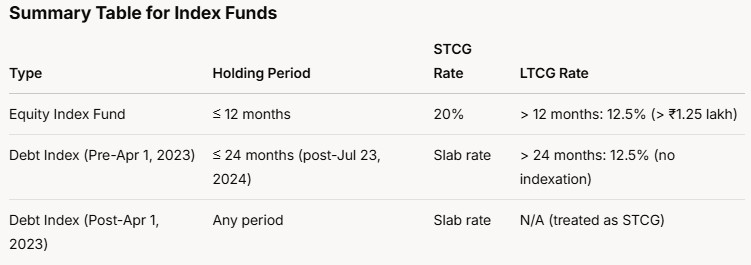

- Holding Period: Less than or equal to 12 months.

- Tax Rate: 20% (increased from 15% as per Union Budget 2024, effective for transfers on or after July 23, 2024).

Long-Term Capital Gains (LTCG):

- Holding Period: More than 12 months.

- Tax Rate: 12.5% on gains exceeding ₹1.25 lakh per year (increased from 10% and exemption limit raised from ₹1 lakh to ₹1.25 lakh as per Union Budget 2024, effective for transfers on or after July 23, 2024).

- Gains up to ₹1.25 lakh are exempt from tax.

Securities Transaction Tax (STT):

Applicable at 0.001% on the sale of equity-oriented mutual fund units on recognized stock exchanges.

Funds that invest more than 65% of their total proceeds in debt and money market instruments (as per the amended definition under Section 50AA of the Finance Act, applicable from FY 2025-26).

For Investments Made On or After April 1, 2023:

- Holding Period: No distinction between short-term and long-term (all gains are treated as short-term capital gains under Section 50AA, Finance Act 2023).

- Tax Rate: Taxed at the investor’s applicable income tax slab rate (e.g., 5%, 20%, or 30% depending on income).

- Indexation Benefit: Removed as of April 1, 2023.

For Investments Made Before April 1, 2023:

- Short-Term Capital Gains (STCG):

- Holding Period: Less than or equal to 36 months (for sales before July 23, 2024) or 24 months (for sales on or after July 23, 2024, per Budget 2024).

- Tax Rate: Taxed at the investor’s applicable income tax slab rate.

- Long-Term Capital Gains (LTCG):

- Holding Period: More than 36 months (for sales before July 23, 2024) or 24 months (for sales on or after July 23, 2024).

- Tax Rate:

- 20% with indexation benefit (for sales before July 23, 2024).

- 12.5% without indexation benefit (for sales on or after July 23, 2024, per Budget 2024).

- Short-Term Capital Gains (STCG):

3. Hybrid Mutual Funds

Hybrid funds invest in both equity and debt. The taxation depends on equity exposure:

Taxation: Depends on the fund’s equity exposure:

- Equity-Oriented Hybrid Funds (more than 65% in equity):

- Treated as equity funds (see above for STCG and LTCG rates).

- Debt-Oriented Hybrid Funds (more than 65% in debt):

- Treated as debt funds (see above for STCG and LTCG rates).

- Equity-Oriented Hybrid Funds (more than 65% in equity):

Balanced Hybrid Funds (35%-65% in equity or debt):

- For investments post-April 1, 2023: Taxed at slab rates if classified as “specified mutual funds” under Section 50AA.

- For investments pre-April 1, 2023: LTCG taxed at 12.5% (post-July 23, 2024) or 20% with indexation (pre-July 23, 2024) if held over 24 months; STCG at slab rates.

4. ELSS (Equity Linked Savings Scheme)

ELSS funds offer tax benefits under Section 80C. They come with a three-year lock-in.

STCG & LTCG:

Taxed like equity funds.

Tax Savings:

Up to ₹1.5 lakh deduction in a financial year.

Dividend Taxation (Income Distribution cum Capital Withdrawal - IDCW)

- Dividends are no longer subject to Dividend Distribution Tax (DDT) since the Finance Act 2020.

- Tax Rate: Added to the investor’s total income and taxed at their applicable income tax slab rate.

- TDS: 10% Tax Deducted at Source applies if the dividend exceeds ₹5,000 in a financial year (for resident investors). Non-Resident Indians (NRIs) face higher TDS rates (e.g., 20% or as per tax treaties).

- Specified Mutual Funds (Section 50AA): As per the Finance (No. 2) Act 2024 (effective FY 2025-26), funds investing more than 65% in debt or money market instruments (or in units of such funds) are taxed at slab rates, regardless of holding period, for investments made on or after April 1, 2023.

- Surcharge and Cess: Additional surcharge (e.g., 15% for income above ₹1 crore, up to 37% for income above ₹5 crore) and 4% Health and Education Cess apply on the base tax.

- NRIs: Subject to TDS on capital gains (e.g., 20% on STCG for equity funds, 30% on debt fund gains), but tax treaties may reduce rates.

How to Save Tax on Mutual Fund Investments

1. Invest in ELSS Funds

ELSS funds provide tax deductions under Section 80C while offering equity-linked returns.

2. Hold Investments for the Long Term

Long-term holdings reduce tax liability, especially in equity and debt funds.

3. Use Indexation Benefits for Debt Funds

Indexation reduces taxable gains, lowering tax on long-term debt funds.

4. Opt for Dividend Plans Wisely

Dividends are taxed at the investor’s slab rate. Growth plans help avoid frequent taxation.

5. Plan Redemptions Smartly

Selling mutual funds in a tax-efficient manner reduces overall tax liability.

Conclusion

Mutual Fund Taxation in India impacts returns. Choosing tax-efficient funds and planning investments wisely can help save more. Understanding LTCG, STCG, and indexation benefits allows investors to maximize gains while paying lower taxes.

Market conditions change rapidly, and staying informed is crucial. Follow reliable financial news sources, analyse expert opinions, and track regulatory updates. Stay connected with us for more insights on market trends and stock analysis.

Disclaimer:

The information provided in this blog is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. Equity investments are subject to market risks, and past performance is not indicative of future results.

This content does not constitute an offer, solicitation, or recommendation to buy or sell any securities, nor does it guarantee any specific financial outcome. Investors should conduct their own research, assess their risk tolerance, and consult with a certified financial advisor or investment professional before making any investment decisions.

The author and publisher of this blog are not liable for any financial losses, decisions, or actions taken based on the information provided. Invest wisely and at your own discretion.