NPS vs PPF vs Mutual Funds: Best for Your Retirement?

Introduction

When it comes to retirement, choosing the right investment plan is important. Many people often compare NPS vs PPF vs Mutual Funds. All three options are popular in India. Each comes with its own benefits and risks. But which one is best for you?

Let’s understand them step by step in simple language.

What is NPS (National Pension System)?

NPS is a government-backed retirement savings scheme. It is regulated by the PFRDA (Pension Fund Regulatory and Development Authority).

Key Features of NPS:

- Partial tax benefits under 80C and 80CCD(1B).

- Long-term investment with pension benefits.

- Lock-in until retirement (age 60).

- Equity and debt exposure.

Pros:

- Low-cost structure.

- Government security.

- Tax saving options.

Cons:

- Limited liquidity.

- Mandatory annuity on maturity.

What is PPF (Public Provident Fund)?

PPF is a long-term savings scheme offered by the government. It is popular among risk-averse investors.

Key Features of PPF:

- 15-year lock-in period.

- Interest is tax-free.

- Principal and interest are both exempt (EEE benefit).

Pros:

- Safe and guaranteed returns.

- Tax-free interest.

- No market risk.

Cons:

- Fixed interest rates.

- Limited investment cap (₹1.5 lakh/year).

What are Mutual Funds?

Mutual Funds are market-linked investment tools. Fund managers handle your money and invest in equities or debt instruments.

Key Features of Mutual Funds:

- Wide range of schemes.

- Higher return potential.

- Liquidity options are available.

Pros:

- High growth potential.

- Flexible investment options (SIP/Lumpsum).

- Easy withdrawal.

Cons:

- Market risks are involved.

- No guaranteed returns.

Success Stories:

Story 1: Safe & Steady Investor – Meena, Age 30

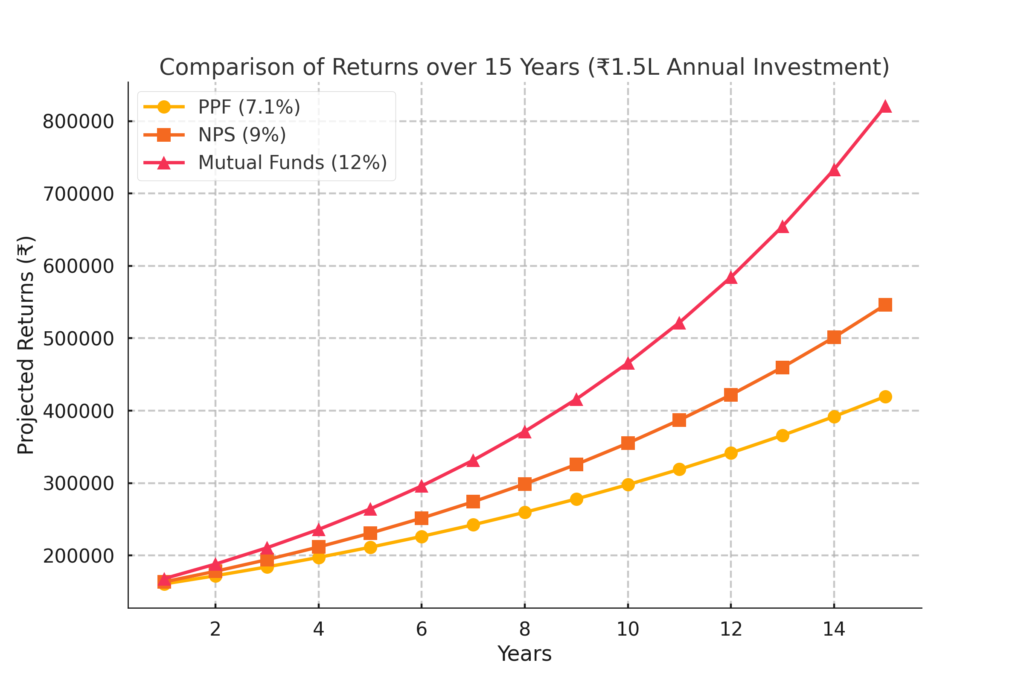

Meena is a school teacher. She prefers safe and fixed income. Every year, she invests ₹1.5 lakh in her PPF account.

After 15 years, her investment grows to approximately ₹40+ lakh (based on 7.1% interest). She gets full tax exemption. It suits her low-risk profile.

Best option: PPF

Story 2: Moderate Risk Taker – Rajesh, Age 35

Rajesh is a government employee. He invests ₹50,000 in NPS and ₹1 lakh in mutual funds through SIPs.

At retirement, he receives a pension from NPS and a large corpus from mutual funds. The mix helps him stay balanced.

Best option: NPS + Mutual Funds (Combination)

Story 3: Aggressive Growth Seeker – Sneha, Age 28

Sneha works in a startup. She starts a ₹10,000 monthly SIP in an equity mutual fund.

In 30 years, her investment grows to ₹3+ crore assuming 12% average return. She accepts short-term risks for long-term gains.

Best option: Mutual Funds

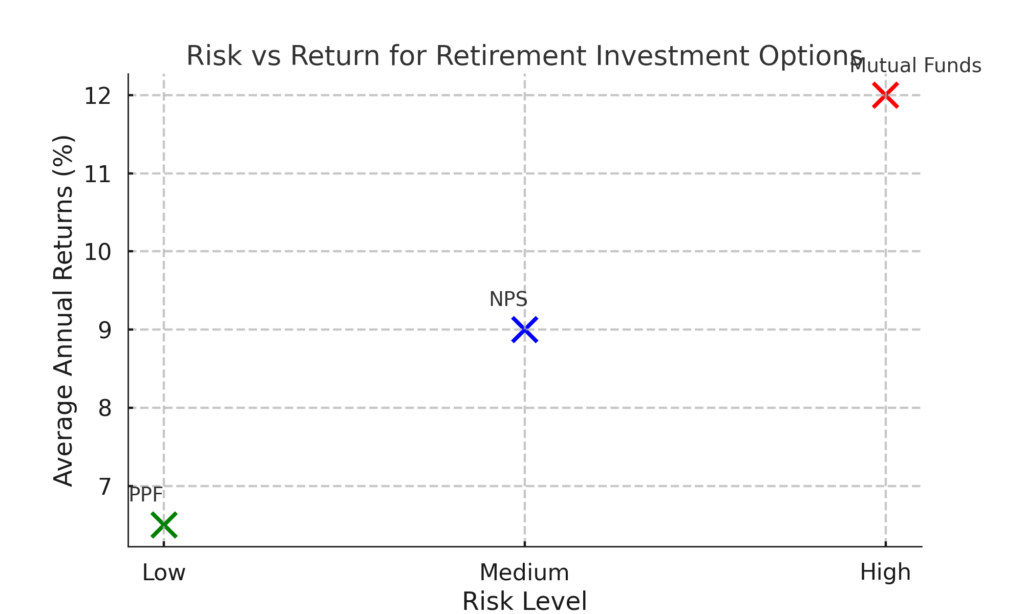

Step-by-Step Guide to Choose the Right Plan -

- Low Risk: PPF

- Medium Risk: NPS

- High Risk: Mutual Funds

- Short Term: Mutual Funds

- Medium Term: PPF

- Long Term: NPS and Mutual Funds

- PPF and NPS offer tax-free options.

- ELSS mutual funds provide 80C benefits.

Step 4: Diversify Wisely

- Use a mix: PPF for safety, NPS for pension, Mutual Funds for growth.

Final Thoughts: Which One is Best?

There is no single “best” option. Your ideal retirement plan depends on:

- Your risk appetite.

- Your financial goals.

- Your tax planning needs.

In short, NPS vs PPF vs Mutual Funds is not a fight. It’s about balance. Smart investors combine them for better results.

Disclaimer: Mutual fund investments are subject to market risks. Please consult a financial advisor before investing.

Market conditions change rapidly, and staying informed is crucial. Follow reliable financial news sources, analyse expert opinions, and track regulatory updates. Stay connected with us for more insights on market trends and stock analysis.

Disclaimer:

The information provided in this blog is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. Equity investments are subject to market risks, and past performance is not indicative of future results.

This content does not constitute an offer, solicitation, or recommendation to buy or sell any securities, nor does it guarantee any specific financial outcome. Investors should conduct their own research, assess their risk tolerance, and consult with a certified financial advisor or investment professional before making any investment decisions.

The author and publisher of this blog are not liable for any financial losses, decisions, or actions taken based on the information provided. Invest wisely and at your own discretion.