Retirement Planning: How to Build a ₹5 Crore Corpus by 60

Introduction

Retirement Planning in India is essential to secure financial freedom and a stress-free life after work. With rising costs and longer life spans, having a solid retirement plan is a must. This article provides simple steps to help you build a ₹5 crore retirement fund by the age of 60.

Why is Retirement Planning Important?

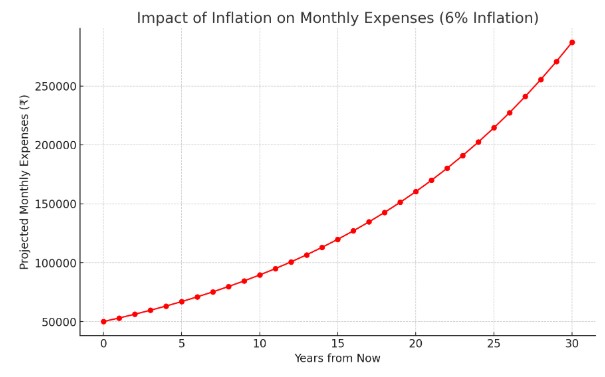

Inflation Impact: Prices keep increasing, reducing the value of your savings.

No Guaranteed Pension: Private-sector employees don’t get pensions like government employees.

Medical Expenses: Health costs rise as you grow older.

Financial Independence: A good plan ensures you don’t have to depend on anyone.

How Much Do You Need for Retirement?

If your current monthly expenses are ₹50,000, and inflation is 6%, you may need around ₹5 crore to cover costs for 25-30 years after retirement.

Step-by-Step Guide to Building a ₹5 Crore Corpus:

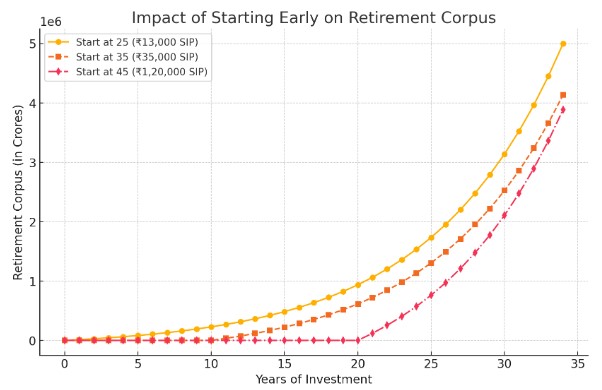

1. Start Early to Benefit from Compounding

If you start at 25, invest ₹13,000 per month (assuming a 12% return).

If you start at 35, invest ₹35,000 per month.

If you start at 45, invest ₹1,20,000 per month.

Starting early makes investing easier and reduces financial pressure.

2. Select the Right Investment Options

To get good returns, diversify your investments:

A. Equity Mutual Funds (60-70%)

Best for long-term wealth creation.

SIPs in index, large-cap, and flexi-cap funds are recommended.

Examples: Nifty 50 Index Fund, HDFC Flexi Cap Fund, ICICI Bluechip Fund.

B. National Pension System (NPS) (10-15%)

Extra tax benefits under Section 80CCD(1B).

Helps with disciplined savings.

C. Public Provident Fund (PPF) (10%)

Government-backed with tax-free returns.

Good for stability in your portfolio.

D. Real Estate or REITs (10-15%)

Earn passive income through rent or Real Estate Investment Trusts (REITs).

E. Gold ETFs or Sovereign Gold Bonds (5-10%)

Gold helps protect against inflation and adds diversification.

4. Save More with Tax Planning

Use Section 80C deductions (up to ₹1.5 lakh) with PPF, ELSS, and NPS.

Invest in Tax-Free Bonds for safer returns.

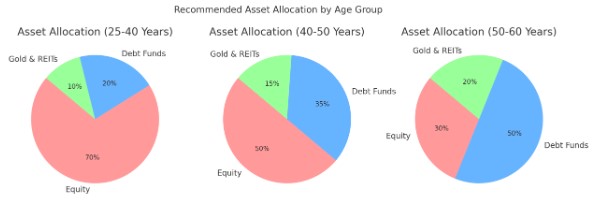

5. Adjust Your Portfolio as You Age

Age 25-40: Keep 70-80% in equities.

Age 40-50: Shift to 50-60% equity and more debt instruments.

Age 50-60: Reduce equity to 30-40% and move to safer assets.

Success Story: How Rahul Built a ₹5 Crore Corpus

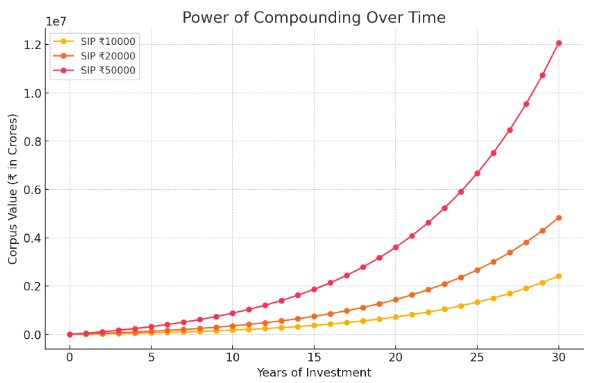

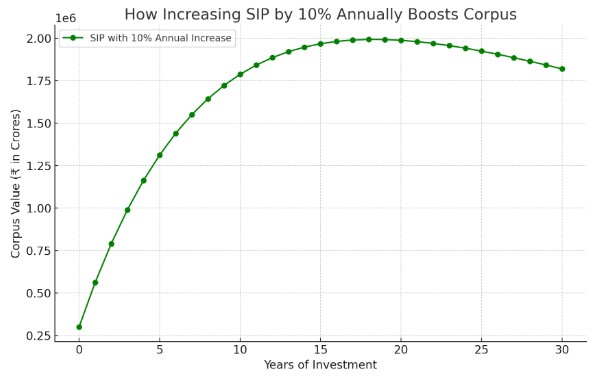

Rahul, a 30-year-old IT professional, started investing ₹20,000 per month in mutual funds and NPS. By increasing his investments by 10% annually, he reached ₹5 crore by 58.

Mistakes to Avoid

Starting Late – The later you start, the more you need to invest.

Only Investing in FDs – Fixed deposits often don’t beat inflation.

Ignoring Inflation – Your savings must grow faster than inflation.

Skipping Health Insurance – Medical emergencies can drain your savings.

Conclusion

Reaching a ₹5 crore retirement fund is possible with smart planning. Start early, invest wisely, and review your portfolio regularly. Take action today to secure your future!

Disclaimer:

The information provided in this blog is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. Equity investments are subject to market risks, and past performance is not indicative of future results.

This content does not constitute an offer, solicitation, or recommendation to buy or sell any securities, nor does it guarantee any specific financial outcome. Investors should conduct their own research, assess their risk tolerance, and consult with a certified financial advisor or investment professional before making any investment decisions.

The author and publisher of this blog are not liable for any financial losses, decisions, or actions taken based on the information provided. Invest wisely and at your own discretion.