SIP vs Lump Sum: Which Mutual Fund Investment Strategy is Right for You?

Introduction:

Investing in mutual funds can help you grow wealth over time. But should you invest through SIP vs Lump Sum? Choosing the right strategy is important. Let’s understand both options and find the best one for you.

What is SIP?

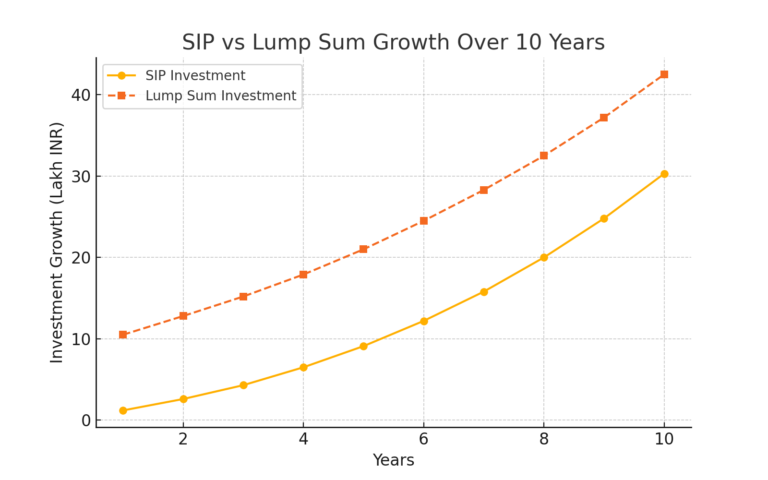

SIP (Systematic Investment Plan) is a method where you invest a fixed amount in a mutual fund at regular intervals. This could be monthly, quarterly, or yearly.

Benefits of SIP:

- Reduces risk through rupee cost averaging.

- Encourages disciplined investing.

- Makes investing affordable.

- Helps in managing market fluctuations.

Who Should Choose SIP?

- Salaried individuals with regular income.

- Investors looking for long-term wealth creation.

- Those who prefer small, consistent investments.

What is Lump Sum Investment?

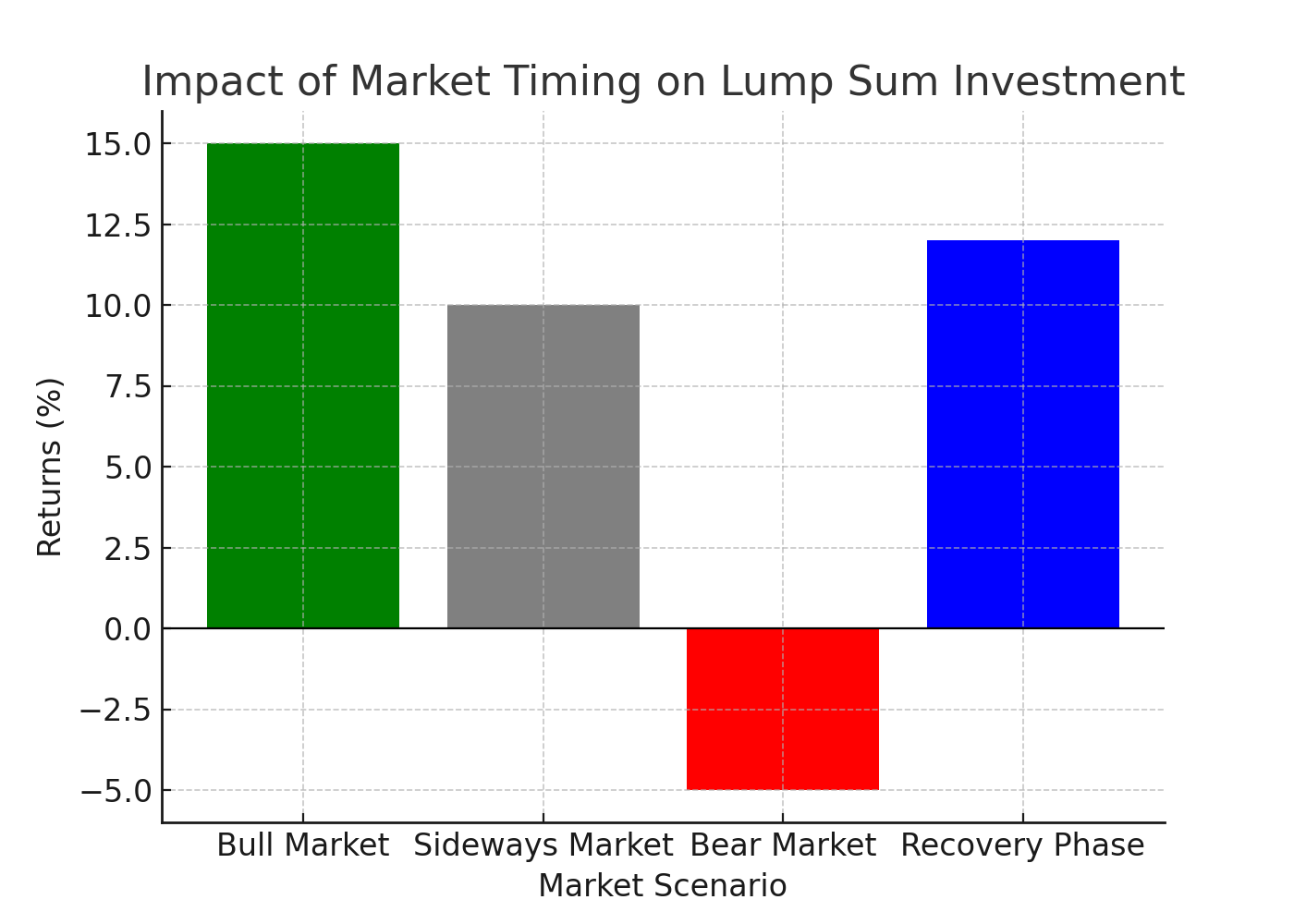

Lump sum investment means investing a large amount in one go. If you have surplus money, this method can help maximize returns when the market is low.

Benefits of Lump Sum Investment:

- Potential for higher returns if invested at the right time.

- Suitable for those with a large investable amount.

- Ideal for investors with a high-risk appetite.

Who Should Choose Lump Sum?

- Investors with surplus cash.

- Those who understand market trends.

- People with higher risk tolerance.

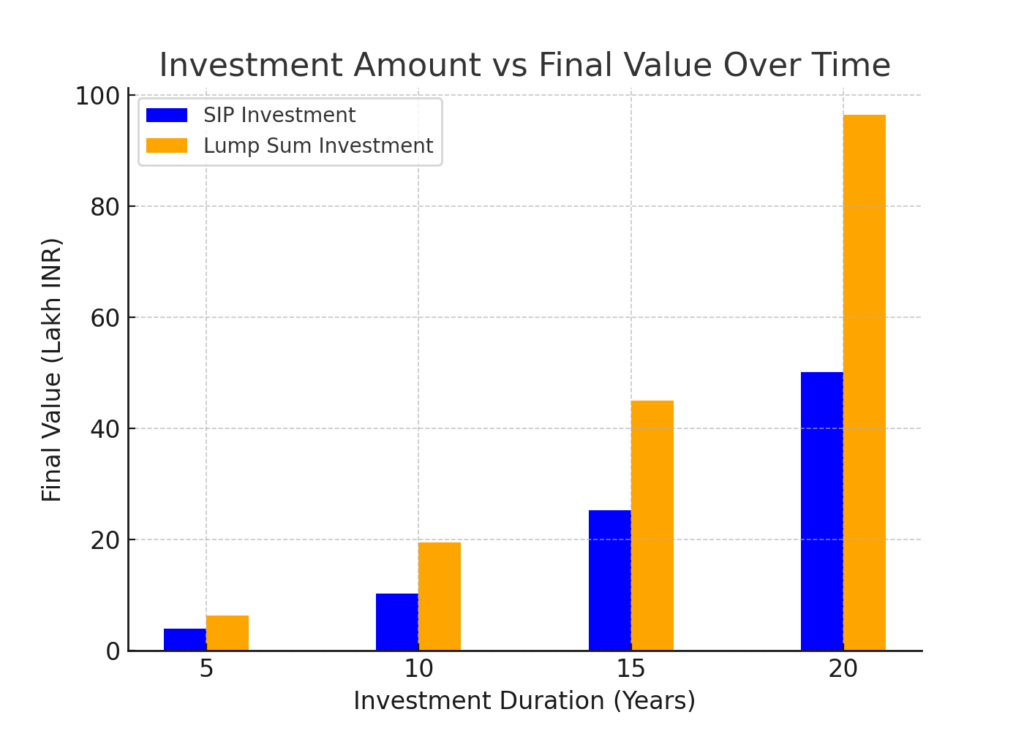

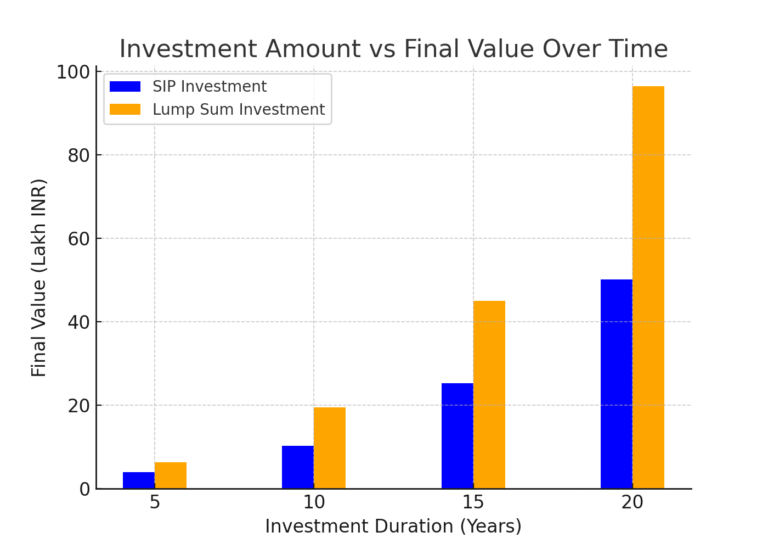

SIP vs Lump Sum: A Quick Comparison

| Factor | SIP | Lump Sum |

| Investment Type | Regular small amounts | One-time large amount |

| Risk Level | Lower risk due to averaging | Higher risk, market-dependent |

| Suitable For | Beginners, regular earners | Experienced investors, those with surplus funds |

| Market Timing | Less dependent on timing | Timing plays a major role |

Which One is Right for You?

- If you want low risk and disciplined investing, go for SIP.

- If you have a lump sum amount and market knowledge, consider lump sum investment.

- For best results, a combination of both can be used.

Conclusion:

Both SIP and Lump Sum have their advantages. Your choice depends on your risk appetite, financial goals, and investment knowledge. Think wisely and start investing today!

Market conditions change rapidly, and staying informed is crucial. Follow reliable financial news sources, analyse expert opinions, and track regulatory updates. Stay connected with us for more insights on market trends and stock analysis.

Disclaimer:

The information provided in this blog is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. Equity investments are subject to market risks, and past performance is not indicative of future results.

This content does not constitute an offer, solicitation, or recommendation to buy or sell any securities, nor does it guarantee any specific financial outcome. Investors should conduct their own research, assess their risk tolerance, and consult with a certified financial advisor or investment professional before making any investment decisions.

The author and publisher of this blog are not liable for any financial losses, decisions, or actions taken based on the information provided. Invest wisely and at your own discretion.