Stock Market vs Mutual Funds: Which One Should You Choose?

Introduction:

Investing is a great way to build wealth. But choosing between the stock market vs mutual funds can be confusing. Both have benefits and risks. Let’s compare them to help you decide.

Understanding Wealth-Building Strategies

Wealth grows through smart investing. Two key strategies are:

- Active investing – Buying and selling stocks yourself.

- Passive investing – Investing in mutual funds managed by professionals.

Both strategies can help you achieve financial freedom.

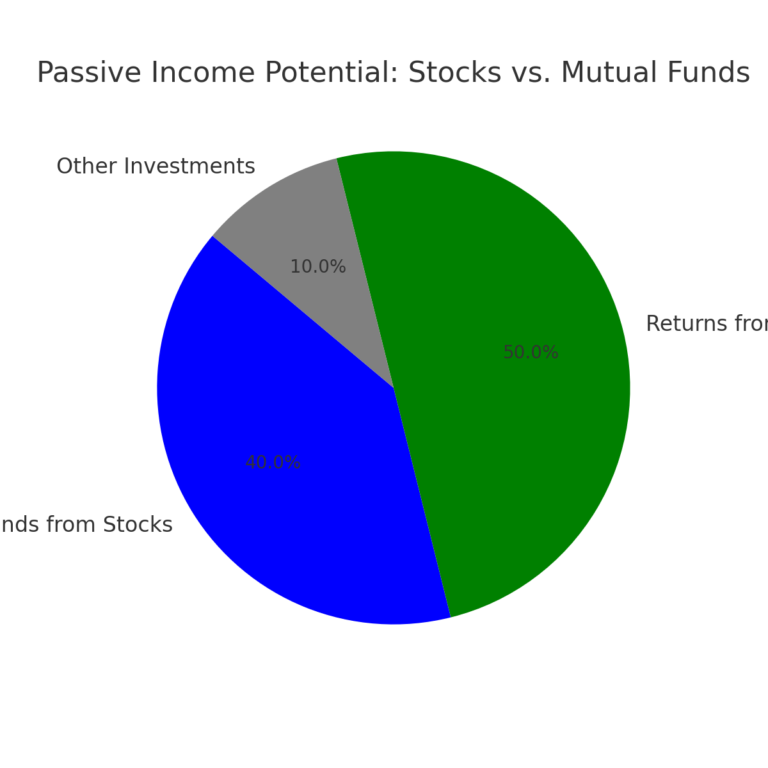

How Passive Income Works

Investments generate income over time. Stocks pay dividends, while mutual funds offer returns based on fund performance. Reinvesting earnings boosts growth.

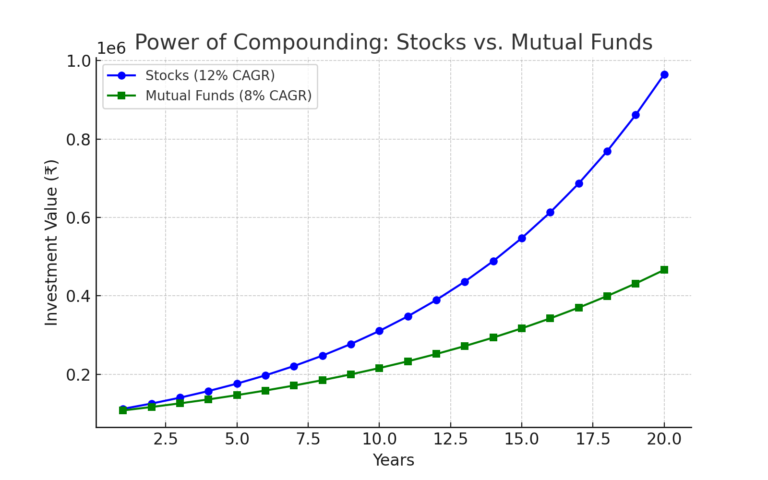

The Power of Compounding

Compounding helps small investments grow. When you reinvest profits, your money earns more over time. This applies to both stocks and mutual funds.

Stock Market vs Mutual Funds: Key Differences

1. Stock Market Investing

- Directly buy and sell company shares.

- Higher risk but potential for high returns.

- Requires market knowledge and time.

- Can offer dividends for passive income.

2. Mutual Funds Investing

- Managed by professionals.

- Lower risk due to diversification.

- Suitable for beginners.

- Can provide steady growth over time.

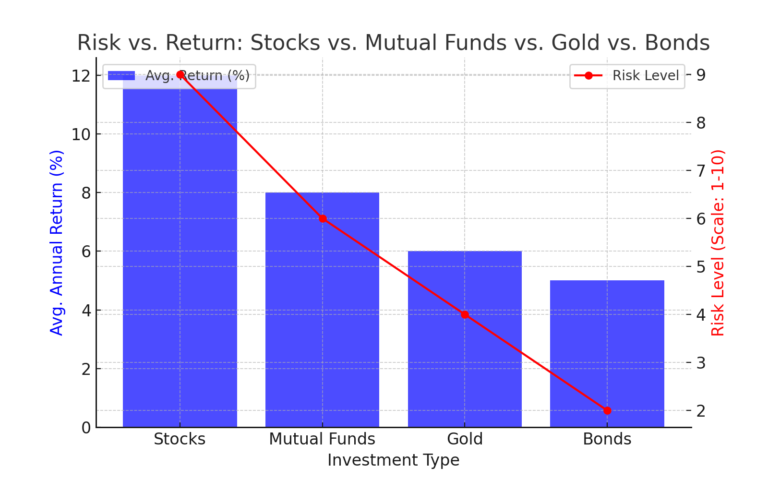

Comparing Stocks, Mutual Funds, Gold, and Bonds

Stocks

- High risk, high return.

- Suitable for long-term investors.

- Requires market research.

Mutual Funds

- Diversified, lower risk.

- Ideal for passive investors.

- Long-term growth potential.

Gold

- Safe investment during inflation.

- Lower returns compared to stocks.

- Good for wealth preservation.

Bonds

- Low risk, fixed income.

- Suitable for conservative investors.

- Less impact from market fluctuations.

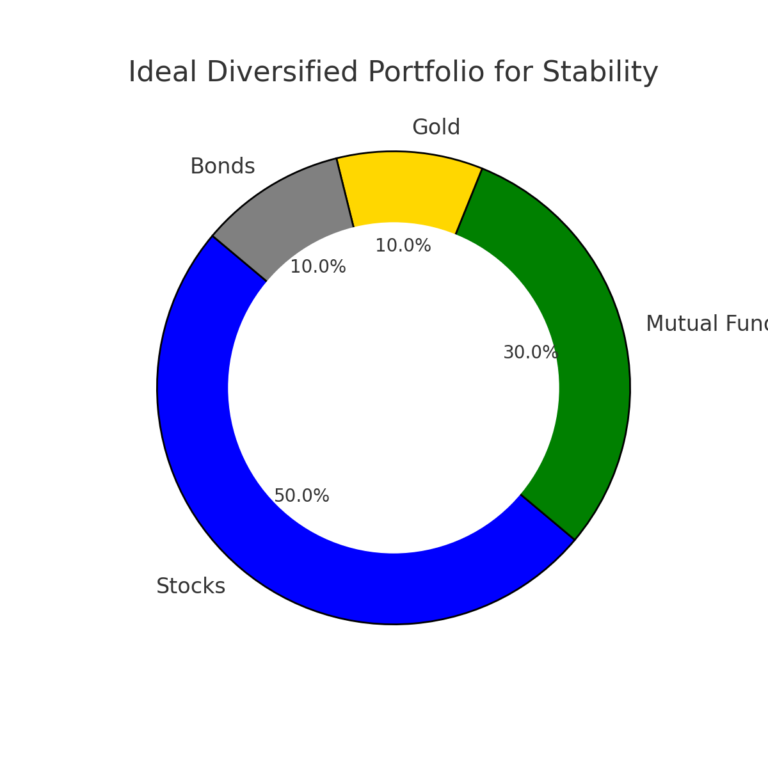

Which One Should You Choose?

If you prefer high returns and control, invest in stocks. If you want low risk and professional management, go for mutual funds. A mix of stocks, mutual funds, gold, and bonds offers balance and stability.

Conclusion:

Both stock market and mutual funds help grow wealth. Choose based on your risk tolerance, investment goals, and time commitment. Diversify for better financial security.

Market conditions change rapidly, and staying informed is crucial. Follow reliable financial news sources, analyse expert opinions, and track regulatory updates. Stay connected with us for more insights on market trends and stock analysis.

Disclaimer:

The information provided in this blog is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. Equity investments are subject to market risks, and past performance is not indicative of future results.

This content does not constitute an offer, solicitation, or recommendation to buy or sell any securities, nor does it guarantee any specific financial outcome. Investors should conduct their own research, assess their risk tolerance, and consult with a certified financial advisor or investment professional before making any investment decisions.

The author and publisher of this blog are not liable for any financial losses, decisions, or actions taken based on the information provided. Invest wisely and at your own discretion.