The Psychology of Investing: How Emotions Impact Decisions

Introduction:

The Psychology of Investing plays a crucial role in financial decisions. Emotional biases often drive investors, leading to impulsive actions. Fear and greed can impact choices, causing losses. A disciplined approach helps in making rational decisions.

One key strategy is Systematic Investment Plans (SIP). Studies show that SIP outperforms lump sum investments over time. This article explores The Psychology of Investing, how emotions affect investing, and why SIP is a better choice for most investors.

How Emotions Influence Investment Decisions

Fear and Greed:

Fear and greed control market movements. Investors panic when markets crash. They also become overconfident in bull markets. These emotional reactions often lead to poor decisions.

Herd Mentality:

Many investors follow the crowd. When others buy, they also invest, fearing they will miss out. During market declines, they sell in panic. This results in buying high and selling low.

Loss Aversion:

Investors fear losses more than they value gains. This makes them hold onto losing stocks for too long. It also prevents them from investing in volatile but profitable opportunities.

SIP vs. Lump Sum Investment: A Data-Driven Analysis

Why SIP Works Better

SIP allows investments at regular intervals. It reduces market timing risks. Lump sum investments, on the other hand, depend on market conditions at the time of investment.

Market Volatility and Cost Averaging

SIP follows the rupee cost averaging method. Investors buy more units when markets are low and fewer when markets are high. This helps in achieving a lower average cost per unit.

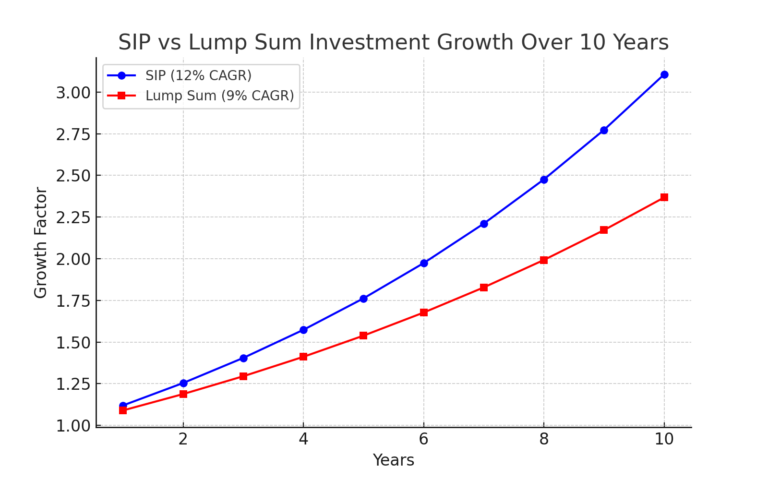

A study by a Financial Research Firm (2023) compared SIP and lump sum investments. The results showed that SIP generated higher long-term returns in 80% of cases.

| Investment Type | Average Annual Returns (10 Years) |

|---|---|

| SIP | 12% |

| Lump Sum | 9% |

An investor who started a ₹10,000 SIP in the Nifty 50 Index in 2010 saw a 15% CAGR by 2023. A lump sum investor with ₹12,00,000 in 2010 achieved a CAGR of 10%. The SIP investor accumulated more wealth with lower risk.

Key Benefits of SIP Over Lump Sum Investment

Lower Risk -

SIP spreads investments over time. Market ups and downs have less impact. This reduces overall risk.

Builds Discipline -

SIP encourages regular investing. This helps in avoiding emotional investment decisions.

Ideal for Beginners -

New investors can start with small amounts. Lump sum investments require a large initial amount, making them riskier.

Conclusion

The Psychology of Investing impacts financial decisions. Emotional investing leads to poor results. SIP provides a disciplined, low-risk approach. Data shows that SIP outperforms lump sum investments in most cases. Adopting a systematic investment strategy helps in achieving long-term financial success.

Market conditions change rapidly, and staying informed is crucial. Follow reliable financial news sources, analyse expert opinions, and track regulatory updates. Stay connected with us for more insights on market trends and stock analysis.

Disclaimer:

The information provided in this blog is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. Equity investments are subject to market risks, and past performance is not indicative of future results.

This content does not constitute an offer, solicitation, or recommendation to buy or sell any securities, nor does it guarantee any specific financial outcome. Investors should conduct their own research, assess their risk tolerance, and consult with a certified financial advisor or investment professional before making any investment decisions.

The author and publisher of this blog are not liable for any financial losses, decisions, or actions taken based on the information provided. Invest wisely and at your own discretion.