Voltas Share Price & AC Stocks: A Seasonal Investment Opportunity

Introduction

As summer approaches, air conditioner (AC) stocks like Voltas, Blue Star, and Amber Enterprises witness increased investor interest. The demand for cooling solutions rises, driving revenue growth and impacting stock performance. In this blog, we analyze the Voltas share price, AC stock trends on NSE and BSE, and the factors influencing their seasonal fluctuations.

Top AC Stocks Listed on NSE & BSE

Voltas Limited (Tata Group) – A market leader in air conditioning solutions.

Blue Star Limited – A premium AC brand known for innovation.

Amber Enterprises India Ltd. – A key original equipment manufacturer (OEM) for AC brands.

Johnson Controls-Hitachi Air Conditioning India Ltd. – Specializing in advanced cooling technologies.

Why Do AC Stocks Perform Well in Summer?

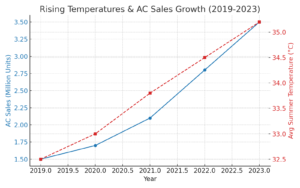

Increased Consumer Demand: Rising temperatures boost AC sales, driving stock performance.

Marketing & Promotions: Brands launch new models and offer discounts, spiking revenues.

Retail & Inventory Stocking: Dealers increase inventory in anticipation of demand.

Economic Growth & Urbanization: More disposable income and infrastructure expansion fuel AC adoption.

Government Policies & Energy Efficiency: Support for sustainable cooling technology impacts investor sentiment.

Voltas Share Price Trends & Financial Performance

Voltas recently reported a two-fold increase in profits due to high demand. In Q1, its net profit surged to ₹3.34 billion, reflecting a 47% revenue jump. The Voltas share price historically rises during the summer due to robust sales. However, investors should monitor seasonal fluctuations, raw material costs, and market competition.

Challenges Affecting AC Stocks

Seasonal Revenue Dependence: Lower sales in winter and monsoon season impact annual growth.

Rising Operational Costs: Higher prices of raw materials like copper affect profit margins.

Intense Market Competition: Continuous innovation is required to maintain leadership.

Conclusion

Investing in AC stocks, especially Voltas, can be lucrative during summer when demand peaks. The Voltas share price shows seasonal strength, making it a compelling choice for short-term gains. However, long-term investors must consider economic trends and market risks.

Disclaimer:

The information provided in this blog is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. Equity investments are subject to market risks, and past performance is not indicative of future results.

This content does not constitute an offer, solicitation, or recommendation to buy or sell any securities, nor does it guarantee any specific financial outcome. Investors should conduct their own research, assess their risk tolerance, and consult with a certified financial advisor or investment professional before making any investment decisions.

The author and publisher of this blog are not liable for any financial losses, decisions, or actions taken based on the information provided. Invest wisely and at your own discretion.